The New Landscape

Just as risk managers and CXOs in financial institutions around the globe had settled into what would be the last credit risk mitigation regulation in 2020, namely CECL (Current Expected Credit Loss), the pandemic hit. Since then, COVID-19 has created three macro changes to ‘reload’ credit risk. First, it validated industry business operating models. Next, it forced a rapid spurt in the evolution of credit risk decisioning. And, finally, it placed tremendous pressure on institutions to prioritize enterprise integration of data. This reload ushered in a new credit risk era that is prompting the efficient redesign of how risk analytics are performed – what we call Efficient Risk Analytics (ERA).

Redesigning Risk Analytics for Efficiency

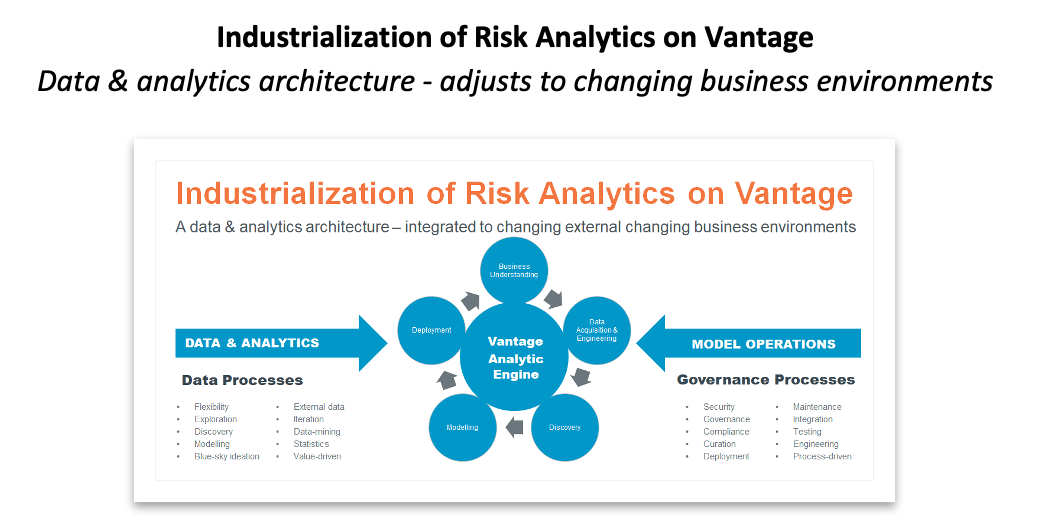

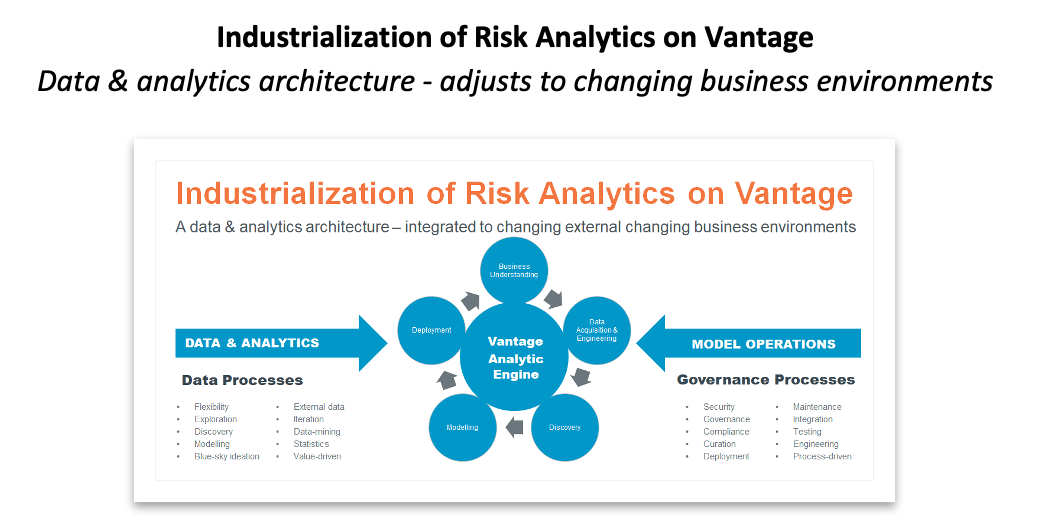

Efficient Risk Analytics is a framework that organizes data and model processes for performance-driven execution and automation. It is an enterprise approach that fixes the shortcomings of siloed risk analytics, across all risk types present in most institutions. ERA is built on a set of principles that feature a “build-it-once and use-many” approach to data that eliminates continual need to source and scrub data for every regulatory or business mandate, automation of model execution and maintenance, and the injection of intelligence into risk decisioning processes. ERA is all about establishing a company-wide standards for risk analytics that support the speed of business driven by digitalization. It also provides a path to enable the essential digital interconnectedness of data in the cloud and through flexible data architectures like data mesh and data access utilities such as Teradata’s QueryGrid.

Modern Operating Models and Services

COVID-19 healthcare measures accelerated everything digital from the start. This unexpected global event magnified the reality of how much businesses like Amazon and industries including telco and financial services are essential for conducting daily life. Connected through digital devices, they created and are now fueling the biggest growth of the platform business model – a business model driven primarily from the desire to deliver personalized services to customers. Nearly every platform business is now sprinting to acquire data that will enable it to gain an edge in this race. At the commercial intersection of retail, telco and financial services are increasingly complex transactions that need to be supported by innovative credit risk services backed by new types of data and real-time risk analytics.

Credit Risk Services for a Digital World

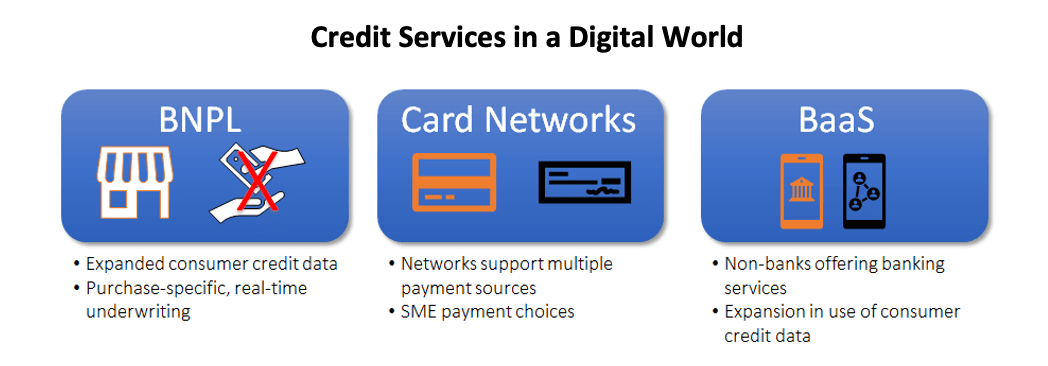

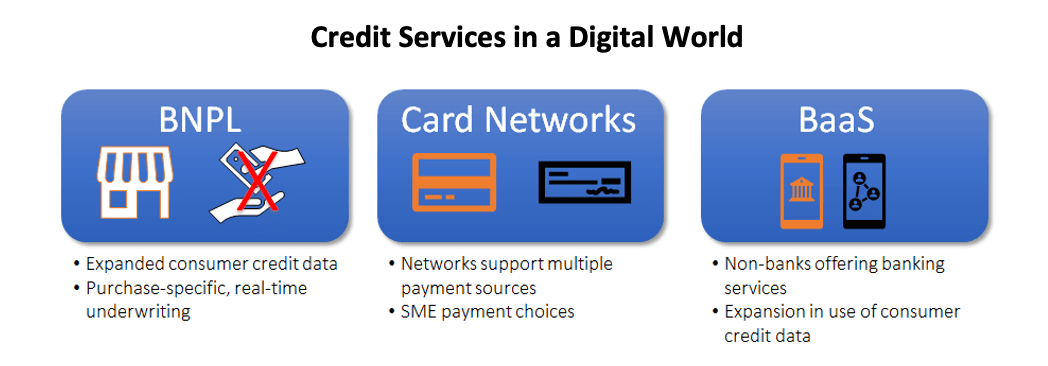

A digital world means the pendulum of product and service design shifts away from an institution’s traditional idea of a product (along with production and distribution) and moves to where the customer is at, what they need when they need it to get on with life. And to support customers’ daily lifestyles, it is essential for institutions to have the flexibly to tap into many new data sources, process large volumes of data workflows and analytics and be part of a digitally connected ecosystems. As a result of this, there is rapid growth in the instant refill of digital wallets, card companies leveraging their networks to offer Small-Medium-Enterprise (“SME”) payments from customer current accounts, P2P (Peer-to-Peer) Lending, Trade Credit, BaaS (Banking-as-a-Service), BNPL (Buy Now Pay Later) instant credit at the point of sale and related services. The accuracy of credit underwriting must be done in real time at the point of sale, which generates a tremendous need to not only access current customer credit data but enhance that decision with new types of non-traditional customer information like behavioral data that is often provided by ecosystem partners. Credit risk decisions can no longer rely simply on a six-month-old credit score – decisioning needs to be accompanied by the characterization of a customer’s needs with insights that extend well beyond the ‘ability and willingness to pay.’

.png?origin=fd)

Re-structuring how we think about data & analytics

Credit risk in the digital world will absolutely require frameworks like ERA. The sophistication of credit services complicated by channel technologies and a variety of non-traditional players offering these services will create explosive demand for new data – triggering the need to gain access to those sources effectively by adopting an ERA approach. Structurally, most, or all the manual model lifecycle processes need to give way to a fully automated process requiring little intervention and enabling an almost continuous model calibration process. Finally, model performance needs to be taken to greater levels.

.png?origin=fd)

Risk analytics is a foundational component to profitable risk and business decision making in the context of a data transaction-centered digital world. In our next blog, we explore a set of emerging risks whose management demands even more of the same capabilities described in this blog.

.png?origin=fd)

.png?origin=fd)